Over the past few months, we have all faced a truly unprecedented situation. The global coronavirus pandemic has affected our families, our businesses, our communities and our way of life, in ways that we could never have envisaged.

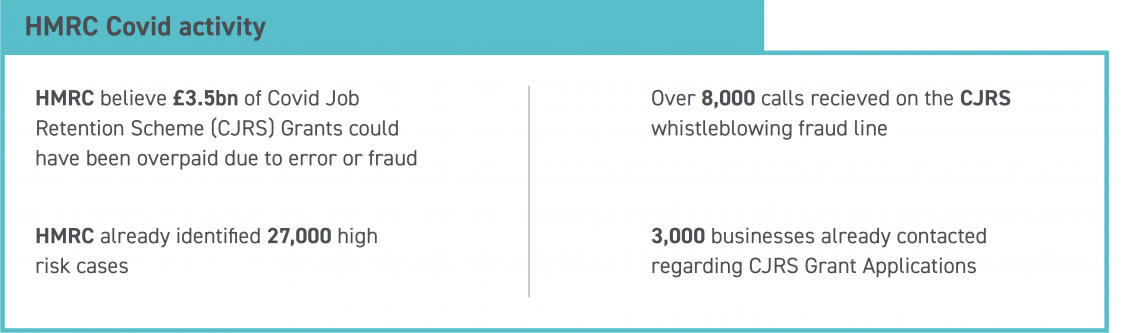

It is more important than ever that you have the right financial protection in place. The full impact of COVID-19 on the Government’s finances and the economy will emerge over the course of the next few years. Businesses have received grants, funding and loans and this is set to continue through this difficult period, but it means that we are expecting to see significant increases in the number of enquiries by HMRC, as they check the validity of applications, and seek to recover payments claimed incorrectly.

HMRC’s enquiries (including reviews and other disputes) can be expensive, time-consuming and stressful, and while quite often the person or business selected has not done anything wrong, it can be a costly exercise simply managing your side of the enquiry.

As your trusted adviser, here at HW Fisher, we can offer you peace of mind from the financial burden of professional fees associated with such enquiries. Our annual Tax Investigation Service will safeguard you and/or your business from the enquiry costs and we will liaise directly with HMRC on your behalf; allowing you to focus on what matters to you.

If you would like to subscribe to our service, please send an e-mail to info@hwfisher.co.uk and we will supply you with the relevant information and service costs. Clients who have already subscribed to this service will receive notices in time for the renewal date of 1st December

We’d love to hear from you. To book an appointment or to find out more about our services: