12th May 2020A Guide to the Coronavirus Job Retention Scheme (CJRS) [Updated]

Under the Coronavirus Job Retention Scheme, announced on 19 March 2020, the Government has put arrangements in place to provide grants to cover 80% of the salary of PAYE employees (up to a capped level) who would otherwise have been laid off during this crisis.

Updates since scheme launch:

- On 12 May, the Chancellor announced:

- The scheme would be extended by four months to October 2020.

- He confirmed that employees will continue to receive 80% of their monthly wages, up to the same cap of .

- From August, companies will be asked to share the cost of the scheme.

- From August, employers currently using the scheme will be able to bring furloughed employees back on a part-time basis (previous guidance was that furloughed employees could not work)

- On 15 April, HMRC announced an extension to the eligibility cut-off date for the Scheme. This new guidance confirmed the eligibility date had been extended to 19 March 2020 in contrast to the original date of 28 February, meaning that employers can claim for furloughed employees that were employed and on their PAYE payroll on or before 19 March 2020.

- The furlough claims portal opened on Monday 20 April and can be accessed by employers or outsourced payroll agents but not “file only” agents or payroll bureaus. Initial furlough payments were released to businesses by the end of April, the first claims being paid within 10 working days; subsequent claims will be paid within 6 working days.

Key aspects of the scheme:

- The scheme will be open to any employer in the country

- It will cover the cost of wages, NIC and minimum pension contributions backdated to 1 March 2020

- It can include workers who were in employment on or before 19 March, this can include TUPE transferred employments after that date

- Redundancies since 28 February can be reversed and the worker furloughed instead

- The scheme is due to be fully operational week commencing 20 April to include March payroll

- The scheme is initially intended to continue for at least three months and will be reviewed by the government thereafter

To claim under the scheme employers will need to:

- Designate affected employees as ‘furloughed workers’, and notify your employees of this change

- Furlough that worker for a minimum of three weeks

- Only furlough employees fit for work. Employees on sick leave cannot be furloughed so are subject to the SSP rules regarding pay and reimbursement, not the Retention Scheme

- Submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal

- Only one claim can be made every three weeks, even if employees are paid weekly

- HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of per month HMRC will set out further details on the information required

- While an employee is furloughed, the worker should not undertake any work for the employer; by doing so, the employer may not qualify for the grant on wages. Online training may be completed without jeopardising the grant. Part-time working may be permitted under the scheme from some time in August but the precise date is to be confirmed.

As of 16 April, we had received further information relating to the scheme:

- The only way to make a claim is online and will include help with calculating the amount you can claim

- HMRC have stated that they expect that claims will be paid within 6 working days

- There has been an important change relating to employee eligibility:

- You can claim for employees that were employed as of 19 March 2020 and were on your PAYE payroll on or before that date

- Employees that were employed as of 28 February 2020 and on payroll and were made redundant or stopped working for you between 28 February and 19 March 2020 can be re-employed and furloughed in order to qualify for the scheme

- There has been further guidance on calculating furlough pay, and HMRC have stated that all the help you need in making the calculations will be available on the portal:

- Your furlough pay calculations should be made up of basic wages, plus (some, all, or none of) compulsory (i.e. contractual) commission payments; past overtime; and compulsory fees (such as monthly membership or learning fees) paid to the employee

- You should not include any discretionary bonuses, or discretionary commission, or discretionary membership / learning fees.

A note of caution

Changing the status of your employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation. Previous variations may not cover returning to part-time working. As such, we would recommend you seek legal advice before you do anything relating to this new initiative.

Rules regarding discrimination apply as normal when selecting employees to be furloughed. However, the National Living Wage rules do not apply when an employee is not working.

Interim measures

While HMRC is working urgently to set up a system for this reimbursement, we understand existing systems are not set up to facilitate payments to employers. We will keep you updated as further guidance is issued and of course, we would be happy to assist with any applications you need to make to HMRC.

Businesses that need short-term cash flow support, may benefit from the VAT deferral policy and may also be eligible to apply for a Coronavirus Business Interruption Loan.

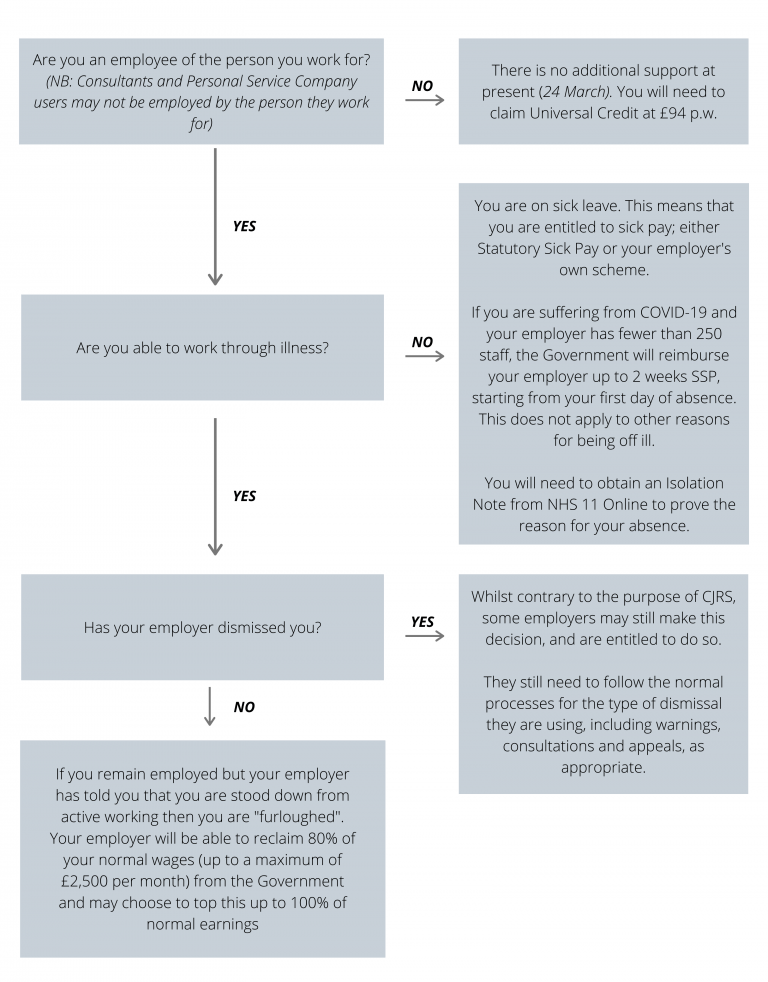

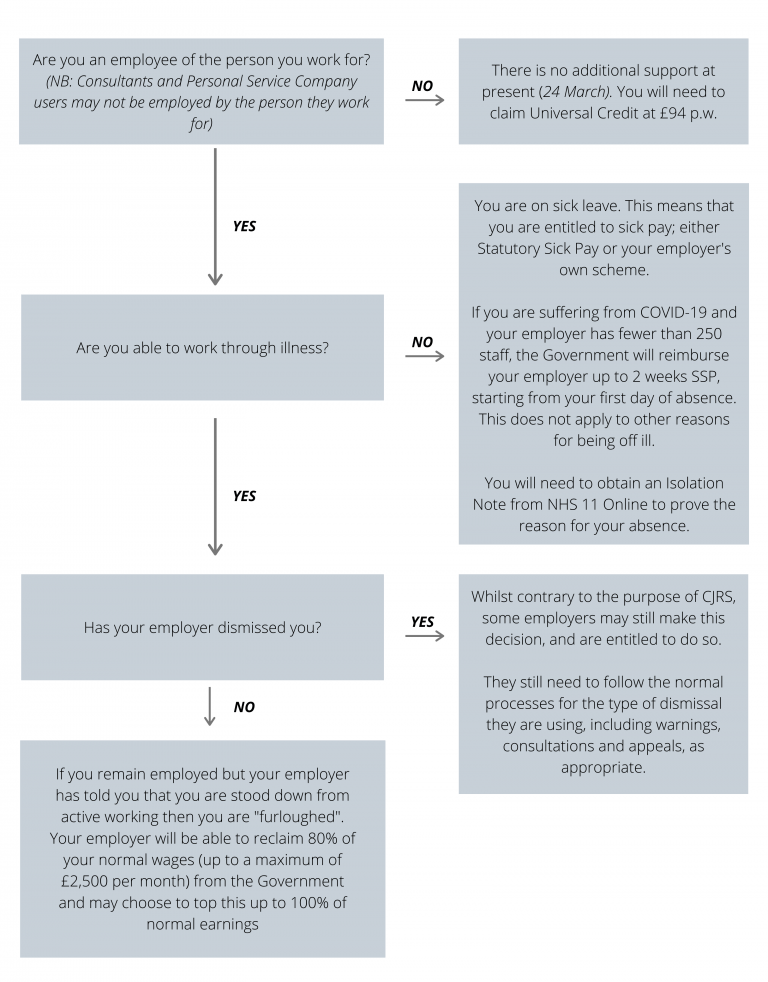

CJRS – What if I am an employee?

FAQ

How long will it take for the Government to reimburse my employer?

We don’t know. HMRC are working on a system to reverse the normal flow of cash so that it goes to the employer. There are loans available for employers to alleviate the timing difference until the system operates smoothly.

Is the cap on the wages or the payment, and is it net or gross of normal taxes?

represents the maximum monthly grant that will be paid under the scheme in respect of salary. In addition to the salary reimbursement the scheme payment covers Employers’ National Insurance and minimum 3% employer’s pension contributions. The true maximum grant is therefore just over per employee per month.

I operate an “IR35” company. Is last year’s “deemed employment income” used to calculate my grant?

Probably not, however we will wait to see. It has long been HMRC’s argument that the tax system should treat employees and PSC contractors the same.

To discuss any of these issues further, or to find out how we can help you, please contact us.

These details are in accordance with Government guidelines on 27 March 2020 and subsequent updates on 15 April 2020 and 12 May 2020.

The information contained in this guidance has been obtained from public sources and every attempt has been made to ensure its accuracy at the date of publication. In this ever changing environment, this information is subject to change and we will not accept liability for losses arising from changes in the law or the interpretation thereof.