With an increase in the number of establishments in China from UK companies, it is highly advisable to seek professional assistance to guide British Investors through the complex setup procedure and outline the roles and responsibilities of key positions in the company. This can be a critical factor in ensuring the success of the venture and avoiding time-consuming changes to the company later down the line. We have worked with Dezan Shira & Associates, experts in providing professional services advice in the pan-Asia region, to put together a series of articles outlining what to be aware of for HW Fisher clients looking to invest in China. This first article explores pre-establishment considerations before setting up in China

In China, the intended scope of a business must be defined in advance of the business establishment. It is an enumeration of the commercial activities in which a business is authorized to operate in.

For British investors, the company operation must be reflected accurately in the business scope. Under the current laws and regulations, UK investors are still regulated or prohibited to engage in specific sectors, as stipulated in the Special Administrative Measures on Access to Foreign Investment (2020 edition) (National Negative List) and the Free Trade Zone Special Administrative Measures on Access to Foreign Investment (2020 edition) (FTZ Negative List)

Depending on the business scope, FIEs (Foreign Invested Enterprises) can be described as being a manufacturing company, a service company, a foreign-invested commercial enterprise (i.e. a trading company), regional headquarters, an R&D center, an investment company, or several others. Often, the capital requirements will differ depending on the type of company that is being incorporated.

Registered capital is the fund all UK shareholders contribute or promise to contribute to the company when they apply to the local Administration of Market Regulation (AMR) for incorporation of the company. The amount of the registered capital depends on a range of factors, which include the region, the sector, the company’s business scope, the planned scale of operations, etc.

The registered capital does not need to be paid completely upfront. The previous system of paid-up capital has been replaced by a subscribed capital model, under which a schedule of contributions must be declared in the Article of Association and be registered with the local AMR in charge. The government will check whether the investors follow the capital injection plan.

There is no minimum registered capital requirement for corporate establishment except few industries, such as banking, financing, insurance, etc. Despite this, in practice, the governing authorities will ensure that a company’s registered capital is sufficient to support its business operations for at least one year, including its rent, labor costs, and office expenses.

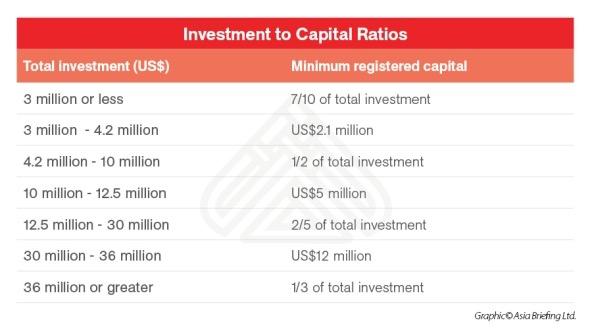

Moreover, the registered capital can affect the amount of offshore debt the FIE can borrow from other investors or foreign banks, if the FIE chooses to follow the ratio between registered capital and total investment as shown in the following chart. The upper limit of the offshore debt is the gap between the total investment and the registered capital.

When setting up a company in China, one inevitably incurs costs prior to the company being formally incorporated. The question then arises what part of these costs may be deducted from the company’s tax bill. This becomes especially relevant if the investment is a large project, such as setting up a factory and purchasing machinery, where the costs incurred prior to incorporation can be substantial.

At this point, it is important to note that a Representative Office (RO’s) in China is taxed on its expenditures. It is therefore in the investor’s interest to, within reason, keep expenses allocated to the RO to a minimum. For this reason, it is advisable to allocate the RO’s pre-incorporation expenses to the UK headquarters.

A Foreign Invested Enterprise (FIE) meanwhile, being an independent legal entity registered in China, is taxed on its income, and may therefore deduct expenses from Chinese tax. As pre-incorporation expenses have been incurred before the FIE formally existing, only some of these expenses can be taken on by the FIE. Of all the expenses made before formal incorporation, only the so-called pre-operation costs (开办费) may be allocated to the FIE and deducted. The key point in defining pre-operation costs is the time when they occurred.

In practice, the starting point of this period is seen as either the establishment date on the business license or the day on which the investor gets the company name confirmation from the Administration of Market Regulation (AMR). This is usually one month before the establishment date on the business license. The ending point of the pre-operation cost period is when the company issues its first invoice or generates its first revenue.

Most of the costs incurred during this period, such as wages, training, printing, transport fees, registration fees, and purchases of items not considered fixed assets, may be deducted if relevant valid tax invoices can be provided. Up to 60 percent of advertising and business-related entertainment expenses (business dinners, gifts, baijiu, etc.) may be allocated to the FIE during this period.

It is often hard to predict what the establishment date of the company will be. This largely depends on how the incorporation process is conducted. However, the better the investor can manage its incorporation process from its side or with its agents, the more clarity and the better the positioning the company can achieve.

Before the company is incorporated, British investors may open a temporary bank account in China, wire foreign currency into this account, and spend these funds on pre-operation and other expenses. After the company has been established, it needs to open a capital account. The funds from the temporary account can then be wired to this account.

In practice, the only cost incurred before the pre-operation cost period is office rent. Allocation to the FIE is accepted, as an office lease is a required step of the incorporation process.

British enterprises, especially manufacturing companies, which often have a long pre-operation period, should take careful consideration of when their pre-operation period ends. These companies in particular need to make sure costs incurred can be carried forward as a loss over the next five years.

For more information on Asia please visit Dezan Shira’s publishing subsidiary Asia Briefing, where you will find related information on:

This article was first published by Asia Briefing, which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, India, and Russia. Readers may write to the Head of UK and Ireland Business Development, and market entry advisor, Maria Kotova at UK.Ireland@dezshira.com

We’d love to hear from you. To book an appointment or to find out more about our services: