The uncertainty surrounding Covid-19 has huge implications on financial reporting. All company directors have a responsibility to prepare financial statements that give a true and fair view of the state of affairs of the company and of the profit or loss for the period. However, the implications of Covid-19 can make this very complex.

Difficulties arise because there remains a great deal of uncertainty. The directors cannot restrict themselves to making statements which they know to be certain but must reflect the uncertainties which apply to the business.

We have detailed below some specific areas that may cause difficulty for some companies in order that directors can think about these issues at the earliest opportunity and where necessary obtain valuations and consider impairment reviews as close to the year-end as possible.

The first key point to consider is what year-end a company has and whether events associated with the outbreak of Covid-19 are adjusting or non-adjusting.

Under UK GAAP an adjusting event is one that provides evidence of conditions that existed at the end of the reporting period and may lead to adjustments in the financial statements. A non-adjusting event is one that is indicative of conditions that arose after the end of the reporting period, these should be disclosed, but would not lead to any adjustment of the figures.

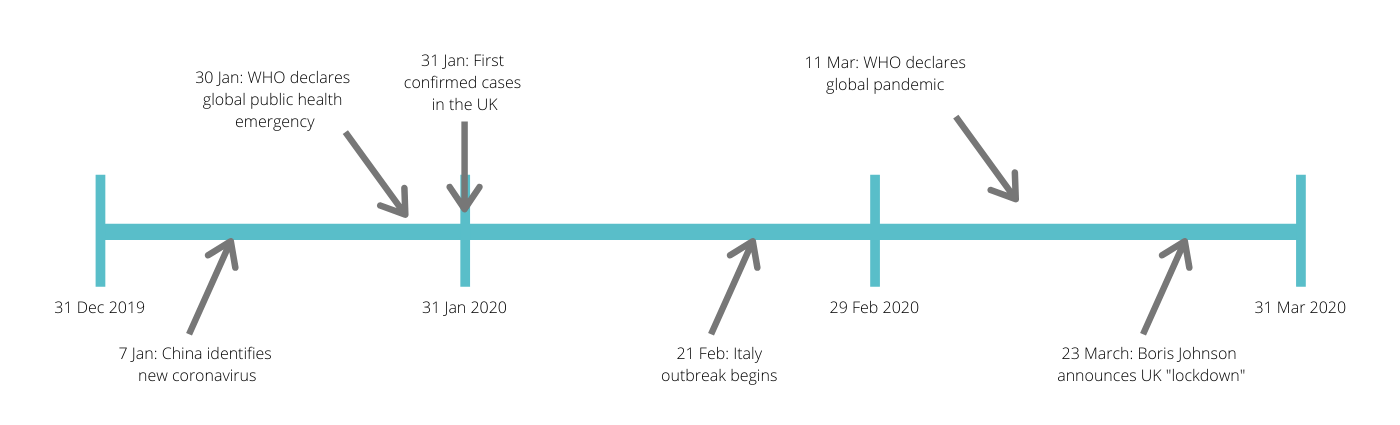

It is therefore important to consider the year-end date and what conditions existed at that date. The following timeline details some key dates in the spread of Covid-19 which may assist with this consideration:

Whether post balance sheet events are adjusting or non-adjusting will depend on your year end date and the specific situation of your company. For December year-ends it is clear from the above that Covid-19 is a non-adjusting post balance sheet event, and for 31 March year-ends it is an adjusting event. However, for January or February year-ends (which are less common) some degree of judgement is required and consideration of the individual situation of the company in order to assess whether events are adjusting or non-adjusting.

If the Covid-19 outbreak is considered to be a non-adjusting event (i.e. for 31 December year-ends), then directors must still assess the impact of that event and disclose any material effects that it would have on the company’s financial position, for example disclosing the effect on the carrying value of assets.

When preparing financial statements, the directors must assess the company’s ability to continue as a going concern. In assessing whether the company is a going concern, the directors should take into account all available information about the future, which is at least twelve months from the date when the financial statements are authorised for issue. When making the going concern assessment the directors must take into account all information available to them at the date the financial statements are authorised, therefore Covid-19 will be the key consideration in most companies’ going concern assessments at the moment.

The financial statements must include detailed disclosure regarding how the directors have concluded that the company is a going concern and any uncertainties that exist that may cause concern (for example Covid-19). Points to consider include the extent to which the entity’s operations may be curtailed during lockdown, but also the extent to which the entity’s customers will be able to continue to use, and pay for, the entity’s goods or services.

Inventories

Directors must ensure that inventories are stated at the lower of cost and the estimated selling price less costs to complete and sell. In the current situation it is important to assess whether the sales price may have decreased, whether costs to complete and sell have increased, for example due to problems in distribution or accessing stock, or if stock is obsolete, for example, if distribution channels are closed for so long that the stock is no longer saleable.

Valuation of properties

Investment properties must be stated at fair value at each reporting date. Difficulties in assessing fair value at the current time are going to make this a particularly challenging estimate in the financial statements. Directors should consider getting independent valuations undertaken of their investment property in order that they have some evidence to present to their auditor. Even though valuers may themselves express some uncertainty in the current climate, auditors will find it more difficult to rely on directors’ valuations given the huge amount of uncertainty in the market.

Impairment of intangible assets including goodwill

Impairment reviews of intangible assets are likely to rely on forecasts of the future cash flows associated with those assets. In the current climate this forecasting will be difficult. The Covid-19 outbreak is an indicator of impairment and therefore impairment reviews will be required on all intangible assets.This review will involve an assessment of the recoverable amounts from each asset; based on forecast future cash flows from that asset (or cash generating unit if the asset itself does not generate cash). The forecast should reflect all conditions that existed at the reporting date, including additional information that came to light about those conditions after the reporting date.

Recoverability of debtors

Clearly many companies are going to be affected by loss of customers, if customers go out of business, or by customers delaying or reducing payments if they are suffering cash flow difficulties themselves. Therefore directors need to carefully assess the recoverability of its debtors and will likely be recognising larger provisions than in previous years.

Onerous contracts

An onerous contract is a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it. Where onerous contracts are identified, the present obligation under that contract shall be recognised and measured as a provision.Onerous contracts could be likely in the current climate for retailers who have leases over shops which are closed temporarily (or even will close permanently), or for contracts with suppliers to purchase stock that can no longer be sold. Directors should carefully review all contracts for cancellation clauses and ensure they understand where there are commitments that need to be met, whether there are penalties for cancellation and whether the contracts may be onerous.

Estimation uncertainty

All of the issues noted above include some degree of estimation and judgement in assessing the measurement of the individual asset or liability. The Covid-19 outbreak has increased the level of uncertainty surrounding estimates in all areas of the financial statements. Therefore detailed disclosure should be made to explain the estimates and the uncertainty surrounding them, particularly those that have a significant risk of resulting in a material adjustment to the financial statements.The higher the level of uncertainty the more disclosure is recommended in the financial statements.

The Strategic Report should disclose the principal risks and uncertainties facing a business and how these are being mitigated by the directors. It is therefore important to think about the disclosures required and how the directors can demonstrate a thorough understanding of the risks and how the business will react to those.

Companies House has announced that because of the impact of Covid-19, on application, they will automatically allow for a three month extension for the filing of company accounts. Companies will need to apply before their filing deadline to take advantage of this.

In extreme circumstances if directors feel they are unable to meet even the extended deadline or if they feel that they are unable to make the necessary judgements and estimates in order to prepare financial statements at the present time, then an extension to the reporting period could be considered.

9 April 2020

The information contained in this guidance has been obtained from public sources and every attempt has been made to ensure its accuracy at the date of publication. In this ever changing environment, this information is subject to change and we will not accept liability for losses arising from changes in the law or the interpretation thereof.

We’d love to hear from you. To book an appointment or to find out more about our services: